What is books?Which way to attach b...

12

10

What is books?Which way to attach books is Excel, handwritten, accounting software?

Thorough comparison of books and how to attach books for [handwritten, Excel, accounting software]!

Books are documents to clarify the company's assets and business conditions by recording the daily money flow (transaction content) in business.

The Corporate Law is required to create and preserve books from stocks.This book must be stored for 10 years from the end of the financial period.For this reason, many people think that creating books is an obligation as a company, and is working on creating and preserving.

However, books are not only obliged to create and preserve as a law, but also provide important information in grasping the business status of the company and considering future management strategies.Also, for freelance people, books are important things that are always required when filing a final tax return.This section describes all of the books, how to apply for each Excel, handwriting, and accounting software.

* In the "Founding Handbook" that writes this article, more fulfilling information is also explained in the thick "Founding Handbook / Printing Version".Please order it because you can get it for free.

Contents of this article

What is a book

As mentioned above, books are documents to clarify the company's assets and business conditions by recording the daily money flow (transaction content) in business.It is based on the profit and loss statement (P/L) and the borrowing (B/S) to be recorded in the financial period, such as the profit and costs, the entry and exit of assets and debt.

Books are like a memo that records all transactions.The settlement is once a year, but the basis for data is a daily transaction record.The book that summarizes the books, which are the transaction records, will be the estimation table, and the financial statements will be created through financial results.In other words, the creation of accurate books leads to the correct financial results.

Some may think that books are troublesome, but if you understand a little rule, you can create it smoothly.

帳簿には「簡易簿記」と「複式簿記」という2つの記帳方法があり、個人事業主やフリーランスの方は確定申告の内容(白色申告or青色申告)によって記帳方法が異なります。白色申告または10万円の青色申告特別控除を受ける場合は簡易簿記(単式簿記)、青色申告特別控除で最大65万円の控除を受ける場合は複式簿記で記帳する必要があります。

Double entry bookkeeping is a bit complicated for simple bookkeeping that can be attached with a household account book even if you do not have knowledge of bookkeeping, but it is not very difficult if you use accounting software such as Yayoi Accounting online.All corporations are bookkeeping in double entry bookkeeping.

法人向けのクラウド会計ソフト「弥生会計 オンライン」では、1年以内に会社設立される or 2017年1月以降に会社設立された方を対象に通常30,000円(税抜)/年のベーシックプラン(電話・チャット等のサポート付プラン)が2年間無料になる弥生×創業手帳 キャンペーンを実施中です!詳しくは以下からご確認ください。弥生×創業手帳 キャンペーンはこちらからOther than the above >> "Yayoi Accounting Online" Self -Plan (26,000 yen excluding tax) and basic plan (30,000 yen excluding tax) are the first year free campaign.

Sole business owner >>> Click here for the first year free campaign where the self -plan "Yayoi no Blue Declaration Online" will be 0 yen for the first year

Corporations are required to create and preserve books by the Companies Act, and if they violate them, they will be fined less than 1 million yen.Sole proprietors and freelancers also have a disadvantage, such as canceling a special blue tax return special deduction if the book is not attached at the time of tax return, or being unilaterally announced by the tax officer during tax audits.There is a fear.By the way, before 2014, if the total income was less than 3 million yen and the total income was less than 3 million yen, it was not necessary to add books, but now white declarations are required to create books.

That's not the only need to keep books.By attaching books, the flow of transactions and money will be clear, and you will be able to accurately grasp whether you are profitable or how much expenses are costing.

If you try to add books, there are many entry items, and you may feel annoying.However, attaching books means creating the basics of the financial statements, and it is a very important task to understand the business performance and financial status of the company and determine the management policy.

If you can manage your accounts receivable and accounts for the company, you can control your cash flow.If you continue your business without visualizing the business situation of the company, your cash flow may be severe in the future.To prevent this from happening, understand the types and how to attach the books to be explained and keep in mind.

Book type

帳簿には記録する内容によってさまざまな種類がありますが、大きく「主要簿」と「補助簿」の2種類に分けられます。ここでは2つの帳簿について見ていきましょう。

主要簿とは、どの会社においても必要不可欠な帳簿で、取引があるたびに必ず記入するものです。主要簿は会社の取引全体を体系的に記録・計算するための帳簿類で、主要簿をもとに試算表が作られ、試算表は決算書(損益計算書や貸借対照表)の作成に用いられます。

一方、補助簿は必要に応じて作成するもので、主要簿の内容を補うために使われます。補助簿は取引の種類ごとに記録するので、主要簿のようにあらゆる取引を記録するものに比べて効率良く集計作業を行うことができ、試算表を作成する際にも役立ちます。しかし補助簿が多いとかえって転記作業などが増えて煩雑になることもあるので、あくまで補助的な立ち位置の帳簿として存在しています。

帳簿には主要簿と補助簿の2種類があると説明しましたが、帳簿類のメインとなる主要簿はさらに「仕訳帳(しわけちょう)」と「総勘定元帳(そうかんじょうもとちょう)」に分けられます。その特徴を見ていきましょう。

When a transaction occurs, first fill in the journal for each date.In order to record all daily transactions in order of occurrence, the journal is sometimes called a journal book book.When recording the journal, the accounting subjects and amount are classified by classification into "deity (karata)" and "kashikata" for each transaction.If the assets increase or costs money, write them in the loans when debts or net assets increase or revenue.For example, if there is a debt of 1 million yen from a bank, you can understand the flow of money by recording the debit "receivable 1 million yen" or "1 million yen for the current account deposit".The amount of debit and the amount of rent always match, and the journal is an important book that is the source of the general ledger.

The general ledger is created by copying the journal described in the journal for each account.The account is the name used to classify the flow of money and transactions, such as receivables, accounts payable, travel expenses, and entertainment expenses.While the journal is a way to grasp the flow of money, the general ledger is to grasp the transaction record in the loading type.Each account can be checked in a list, so it is useful when you want to understand each balance immediately.In the financial period, financial statements such as balance sheet and profit and loss statement are created based on this general ledger.

In the auxiliary book, we will fill out detailed information that is not in the main book for specific accounts.By creating an auxiliary book, the company's business situation can be more accurately grasped, so it can be said that it is an indispensable book, although it is called auxiliary book.

Typical of the auxiliary books are "Genkin Suitotcho", "Deposit Delivery Book", "Urika Kakecho", "Kaikakekai"."Expense book" and "fixed asset ledger", but not all auxiliary books are required, but are created as needed.

It is a book recorded when cash transactions are performed, such as purchasing, sales, accounts receivable, collecting accounts receivable, and paying expenses.Enter the deposit and withdrawal in the order in which the transaction occurred, and confirm that the cash balance on the book and the actual cash balance match.By adding a cash book, the increase / decrease of daily cash is visualized, which is useful when planning a fund plan.

Enter the deposit and withdrawal movement in the deposit account in order of date and manage the balance.In order to record all deposits and deposits for each financial institution account, the deposit book must be prepared as many deposit accounts with trading.The deposit book has the role of clarifying the deposit balance as a company.By the way, unlike deposit books, only a part of information such as withdrawal date and transfer amount is described, so it is not possible to grasp the flow of all cash in the depositbook.

Unpaid payments that have been increased but have not received any money are called accounts receivable, but it is a ranging book that manages the balance of the accounts receivable for each business partner.If the accounts receivable is not managed and the business partner is not able to make the right claim, they may not only lose themselves but also lose their credit.So when the sales rose (when the invoice was issued to the business partner or when the reward was confirmed), the receipt was recorded in the receipt and the amount of accounts receivable, and the amount was received at the time of receiving the accounts receivable.I will record.If you provide a product in credit payment or receive the price one month after delivery of the product, you will be confused if you do not keep a record somewhere.In that case, this account book is used, which will help you to collect your sales price.

Contrary to the accounts receivable, although products and raw materials are purchased, the unpaid money that will be paid later is called a costume, but it is a bagbook that manages the balance of the accounts payable for each supplier.The worship book is a book directly connected to the payment work, and you cannot understand where and how much you pay if you do not have a bagbook.If you are always paying cash, you do not need to buy a library, but ingredients such as ingredients are often carried out by dealing, so for the food and beverage industry, the worship book is indispensable.It is an important book that cannot be done.By the way, accounts payable is used for products purchased for the purpose of selling in -house, and unpaid money is an account that is used for other expenses.

It is a book created by a business operator that owns fixed assets, which is useful for asset management.Fixed assets are purchased for more than 100,000 yen and are used for business for more than a year.Equipment such as machines, cars, and personal computers used in the business, and the fixed asset ledger is also an important thing that is also involved in tax calculations.We will fill out the asset category, service life, date of acquisition, depreciation method, acquisition amount, etc., and update it at the time of depreciation once a year.

~ Other typical auxiliary book list ~

It is a book that summarizes the transaction content and the amount of transactions for each customer, and is also called "accounts receivable ledger" or "customer book".When a reward (accounts receivable) is generated or the accounts receivable is transferred, if there is a transaction that causes an increase or decrease in accounts receivable, it will also be booked in the "accounts receivable account" in the "General Account Book".

It is a book that summarizes the transaction content and the transaction amount for each supplier, and is also called the accounts receivable book.

In the books to be booked when reward transfer or expenses are paid by bills, payments of the bill (paying the price), the transferor (the person who shaked the bill), and the bill settlement are completed.You can see if you are there.In the receiving bill filling book, the date and bill type of the bill received are written, but in the case of a promised bill, it is described as "about hand", and for foreign bills, the bill number is also written.。

法人向けのクラウド会計ソフト「弥生会計 オンライン」では、1年以内に会社設立される or 2017年1月以降に会社設立された方を対象に通常30,000円(税抜)/年のベーシックプラン(電話・チャット等のサポート付プラン)が2年間無料になる弥生×創業手帳 キャンペーンを実施中です!詳しくは以下からご確認ください。弥生×創業手帳 キャンペーンはこちらからOther than the above >> "Yayoi Accounting Online" Self -Plan (26,000 yen excluding tax) and basic plan (30,000 yen excluding tax) are the first year free campaign.

Sole business owner >>> Click here for the first year free campaign where the self -plan "Yayoi no Blue Declaration Online" will be 0 yen for the first year

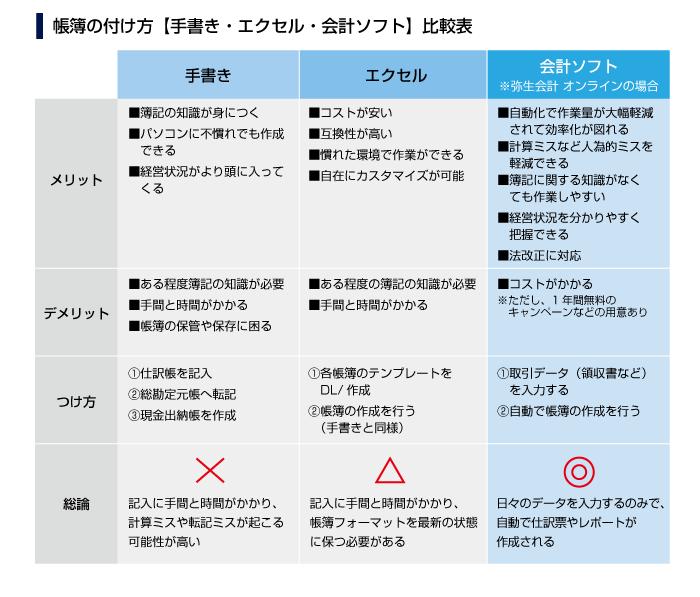

How to attach books [Handwritten / Excel / accounting software] Thorough comparison

Speaking of books, in the past, everything was handwritten.But now, you can choose how to attach three patterns of handwriting, Excel, and accounting software.Each has its own advantages and disadvantages, but the conclusion is that books with accounting software are also recommended.Let's look at how to attach the actual books.

If you have enough time and want to gain knowledge of bookkeeping, it's not bad to try handwriting.By handwriting, you will naturally acquire knowledge about bookkeeping and declaration procedures.If you get used to the tips for writing and get used to the technical terms, including accounts, it will be your own skills in the future.

Handwriting can be worked without going through a personal computer, so you can simply add books like putting a book or a household account book.If you are a small company or sole proprietor with so many transactions, handwriting may be less burdensome.

Handwritten books means that you can understand the business status that you have even more placed in order to carefully organize and shape the flow of money.There are some sole proprietors who do not have a cash account that understands the flow of cash and balance of daily cash, but by handwriting by handwriting, you will be aware of the balance.If you have enough time, handwriting is also recommended in the sense of reviewing your business.

To attach books by hand, you need to learn the terms and writing methods you need to attach books.If you don't have some knowledge of bookkeeping, it may be difficult to put a book by hand.Check the books on the Internet and bookkeeping texts and try to see the sample.

Not only bookkeeping, manual work takes more time and time compared to work using a personal computer.If you have a personal computer, you must transfer all the parts that can be used by copying and paste by hand.If there are few transactions, it will not take much time, but if you have a certain number of employees, be prepared for a huge amount of time and time.If you want to put a book by hand, do it with plenty of time.

If you use Excel or accounting software, you need to calculate all parts that can be calculated automatically.At that time, even if a calculation error occurs, it is hard to find and it takes time.Above all, the general ledger is created in the form of posting from the journal or cash book, so the same number must be copied many times.If you do not work carefully, you will get a mistake immediately.

According to the Companies Act, the book must be kept for a certain period of time after the financial results are over.Books such as journals and general account ledger have a 10 -year storage period, so if you create it by hand, you need to keep it somewhere (individual who has filed a blue declaration.Business owners are also obliged to preserve for seven years).Unlike accounting software stored on the cloud, there is no backup, so it is better to copy it in case of emergency.

I will explain how to write the books by hand writing the books by hand.The declaration and financial results are required to have a main book (journal and general account book) that summarizes all transactions and auxiliary books (such as cash dating books) that manages transactions for each purpose, but here are the minimum required items.to introduce.

1.The journal, one of the main books to fill out the journal, is the basics of books that are always required by any company.If you put a book by hand, fill in this journal.The journal is a date, dates, and six items: date, debit account, debt amount, credit account, credit amount, and excitement.It should be noted at this time that the amount of debt and the amount of money matches.There is no fixed format, so let's create while referring to the Internet and bookkeeping text.

2.The journal described in the journal to be transferred to the general ledger will be copied by accounts such as accounts receivable, accounts for accounts, travel expenses, and entertainment expenses.Please proceed carefully so that you do not make a mistake in each number when copying.During the financial period, it is a very important task because we will create financial statements such as balance sheet and profit and loss statement based on this general ledger.

3.There are various types of auxiliary books that make up a cash book and the general ledger to supplement the general ledger, but most companies are needed in cash.Cash books are books recorded when cash trading is performed, such as purchasing, sales, accounts receivable, collection of accounts receivable, and paying expenses, so keep a record of daily transactions as in the journal.To go.It is only necessary to hold down the three points of the amount of cash, the balance, and the description, so you can create it in a format that you can do easily.If you are difficult to understand, create it while referring to the Internet and bookkeeping text.

Excel is a cover -calculation software used by many businesses, so if you use it originally, there will be no introduction cost.However, if you are not used on a regular basis, you need to be careful because the monthly fee will be charged.

Excel is installed on many personal computers and does not differ depending on the PC environment, so you can take over the same data immediately if you change your computer.One of the advantages is that it is highly compatible, such as being able to easily share data with internal or external tax accountants.

Excel is also used for applications other than books, so it is almost impossible to use it because it is unknown.There is no complicated initial setting, and in the sense that you are used to the operation, you can improve the efficiency of work.

Excel can be customized by forming macros and functions, so it can be said that the degree of freedom is high.You can change the specifications so that the person in charge is easy to use, or incorporate the rules with business partners to make it easier to use.

In order to attach books with Excel, as well as handwriting, you need to learn the necessary terms and writing when attaching books.To create a format, you need some knowledge.

Excel is a basic calculation software, so you need to create book formats.It will take time and effort to start work.

1.Creating templates for each book is full of templates of various books on the Internet.First, let's unify the templates of each book in order to equalize the calculation of tax payments and insurance premium journals.All you have to do is create the format.

2.Once the format to create a book is decided, fill in the journal and post the data to the general ledger.Create cash books as needed.Excel can be calculated and copy and paste automatically, but fine work is the same as when putting books by hand.Fill it in the relevant part and complete the book.

The biggest advantage of introducing Yayoi Accounting online is that it can reduce the amount of work and time and time. Because it is designed to be specialized in accounting operations, if you launch the software, you can start input work immediately, and you will automatically calculate and post, so the processing will be completed before you think about it. It is a sense of speed. In manual work, we made three books, a journal, a general account, and a cash book, but in Yayoi Accounting Online, if you enter the contents of the transaction, you will automatically create various books and general account ledger. Give me. In addition, AI automatically journals the transaction data such as bank statements, credit cards, receipts, receipts, and data taken with smartphone apps, so you can save time input and journal. Efficiency can reduce labor costs and lead to cost reduction.

Yayoi Accounting Online automatically performs calculations and posting, greatly reducing the probability of making mistakes.Even if there is a problem, it will be displayed so that you can see it, and it is no exaggeration to say that the calculation mistake will not occur first.

In the case of Yayoi Accounting online, only the journal of each transaction is done.The input site has a pull -down function that allows you to select a trading subject, so you can immediately put books without specialized knowledge.In addition, Yayoi Accounting Online has a function that can easily create financial results by simply following the screen guidance.Balance sheet, profit and loss statement, and shareholder equity, such as shareholder, can be easily created.It can be said that it is a friendly work environment for beginners.

If you use Yayoi Accounting online, you will have a habit of attaching books on a daily basis, so you can check the company's performance in real time.The results of the transactions entered every day are displayed in an easy -to -understand graph.By analyzing business performance, you can expect the effects beyond the range of booking.

In the case of Yayoi Accounting Online, the latest version can be used at any time, so the laws and regulations are also safe.In the case of installation software, the latest products will respond to laws and regulations, so you will not need to change your own or format books yourself.

Compared to handwriting, there is a price for convenience, such as a continuous usage fee.Costs can be reduced by using campaigns that can be used for 0 yen a year.

1.Enter the transaction data (such as receipts) to enter the items of each software, such as trading date, subject, transaction means, amount, etc.

2.If you enter a trading journal in a journal that automatically creates books, you will automatically calculate and post, so there is no problem if you proceed according to the instructions of accounting software.In addition, Yayoi Accounting Online offers a fulfilling website article and customer center for daily accounting operations such as books.If questions come out, it should help you solve it.

If you want to add bookkeeping or accounting knowledge, Yayoi accounting is recommended!

"Yayoi Accounting" is supported by users of various industries, from beginners to veterans, and sales are NO..It is accounting software that records 1.The reason is the design that can be easily used by beginners and fulfilling support.Let's take a closer look at the recommended points in booking.

弥生会計は、会計、販売管理、給与計算など、業務経験がない初心者の方でも、かんたんに使いこなせる設計を追求しています。勘定科目について知らない初心者の方でも、「かんたん取引入力」を使えばわずか4ステップで登録が完了。自分に合った記帳方法が選べるので安心です。取引の種類を選んで日付と金額を入れるだけで、入力した内容は関連する帳票に自動転記。集計表も決算書も簡単に作成できます。

Still, if you are worried about the journal, you can consult with a support plan.(Yayoi Accounting Online is a basic plan, Yayoi's white declaration and blue declaration online are for total plan)

Yayoi accounting that can be used without hesitation with a simple design that is easy for beginners to understand.Just enter the date or amount, you can create documents such as double -entry bookkeeping books and balance sheets required for blue declaration.

弥生会計は紙のレシートからクレジットカードの取引データ、オンライン請求書データ、POSレジシステムで入力したお店の売上データまで、自動取込・自動仕訳が可能です。

It takes time to enter a paper receipt or receipt by hand.In Yayoi, if you read it with a smartphone or scanner, you will recognize the letters and convert it to data, and the AI automatically carries out journals.You can easily search and confirm the certificate.In addition, a financial institution that Yayoi is linked can automatically get transaction data.

Also, if you are going out a lot using transportation, if you import data from a transportation card, a journal may be created every time you get on and off, and it may become a huge journal data.In this case, it will be difficult to check other journal data.The "Summary Journal" function automatically determines transactions in the same subjects, such as travel expenses transportation expenses, and create one journal compiled every month.In this way, you can significantly reduce the time and effort to the bookkeeping because you only need to check the input contents after automatic import and automatic journal.

弥生会計では、会計業務だけにとどまらず、いつでも経営状態がわかるグラフ・レポート機能や経営を支援するサービスも提供しています。日々の取引データを入力しておくだけで、レポートを自動で集計。決算や確定申告の時期にならなくても、事業に利益が出ているのか等リアルタイムで確認できるので、経営状況を把握して早めの判断を下すことができるようになります。

Yayoi Accounting has a product for corporations and for sole proprietors, and can properly respond to daily bookkeeping and financial statements.In addition, the first free campaign is underway!

2人に1人が使っている「弥生会計」の初心者向けクラウド会計ソフト「弥生会計 オンライン」では、・1年以内に会社設立される or 2017年1月以降に会社設立された方を対象に、「弥生会計 オンライン」ベーシックプラン(電話・チャット等のサポート付プラン)の通常30,000円(税抜)が2年間無料になる「弥生×創業手帳 キャンペーン」・対象でない方にも「弥生会計 オンライン」セルフプラン(税抜26,000円)、ベーシックプラン(税抜30,000円)が初年度0円となる「初年度無償キャンペーン」を実施しています!

Please apply for the Yayoi × Founding Handbook Campaign from the following founding notebook request form.

弥生×創業手帳 キャンペーンに申し込む* For details, please see the Yayoi x Handbook Campaign page.

また弥生×創業手帳 キャンペーンの対象ではない方も、初年度無償キャンペーンをご利用いただけます。下記の弥生Webサイトで詳細をご覧ください。

初年度無償キャンペーンに申し込むFor sole proprietors who file a blue declaration, we recommend "Yayoi no Blue Declaration Online", which has a fulfilling beginner guide.

Currently, "Yayoi no Blue Declaration Online" (self -plan) is usually held for 8,000 yen (excluding tax)/year, which will be 0 yen for the first year!Please check the details from the button below.

やよいの青色申告 オンラインの詳細をみるFor those who do not need to declare blue, we recommend "Yayoi's White Declaration Online".It is a final tax return software that all functions can be used for free!Please check below for details.

やよいの白色申告 オンラインの詳細をみるsummary

Books are very important to record daily transactions, and create income statements and balance sheets based on them at the time of financial results.Unlike the days when handwriting or Excel had only books like a long time ago, there are accounting software like Yayoi Accounting online with convenient functions.Book creation is a business accounting business that both corporations and sole proprietors must do in any industry.If you are not good at it, why not consider introducing accounting software once?

(Supervision: Yayoi Accounting) (Edit: Founding Handbook Editorial Department)

このカテゴリでみんなが読んでいる記事 1位 SPONSORED会計・税金What is a book? 帳簿の付け方はエクセル・手書き・会計ソフトどれがいいの? 2位 SPONSORED会計・税金赤字でも確定申告は必要なのか?やるべき理由を徹底解説! 3位会計・税金領収書の収入印紙は必要?今更聞けない収入印紙の基礎知識を解説!