Olympus and 4Q have achieved two -d...

10

08

Olympus and 4Q have achieved two -digit growth in both the endoscope business and the treatment equipment business.

highlight

Mutashi Takeda: Hello everyone.It is Takeda of CFO.Thank you very much for participating in Olympus Co., Ltd., Olympus Co., Ltd.First of all, I will explain the consolidated financial statements for the fiscal year ending March 31, 2021 and the full -year business outlook for the fiscal year ending March 2022.

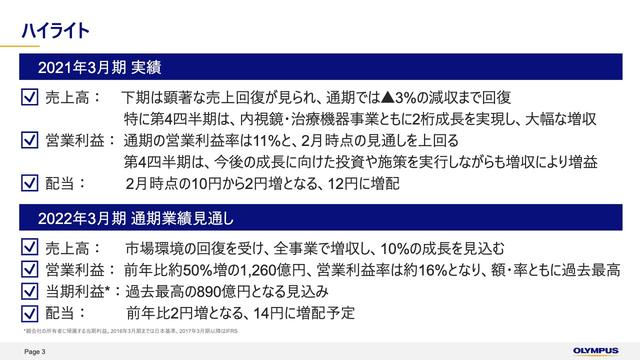

Please see the 3 pages of the slide.This is the main point in consolidated achievements in the fiscal year ending March 2021.

It is sales.It was a recovery trend from the second half, especially in the fourth quarter, and both the endoscopic business and the treatment equipment business have grown two digits, significantly increasing the sales.Following the remarkable recovery in the latter half of the year, the full -year consolidated sales surpassed the outlook for February, and the number of sales was reduced by 3 %.

Operating profit ratio for the full year is 11.It is 2 % and exceeds the outlook.In the fourth quarter, investments and measures to improve business growth and efficiency were implemented, but sales were increased mainly due to the increase in sales.The dividend will increase by 2 yen from the forecast of 10 yen per share and to 12 yen.

Next, we have a full -year business outlook for the fiscal year ending March 2022.Sales were increased in all businesses due to the recovery of the market environment.We expect 10 % growth.

Operating income is about 50 % from the previous year to 126 billion yen.Operating profit margin is about 16 %.The profits are 89 billion yen, both of which are expected to be the highest ever.The dividend is scheduled for 14 yen, which will increase by 2 yen from the previous year.

Final year of 2021 full -year results

I would like to explain the consolidated business results and business overviews for the fiscal year ending March 2021.See 5 slides page.This is an overview of consolidated achievements.

As a timely disclosure announcement on April 30, sales and each stage profit exceeded the outlook as of February due to the solid business throughout the consolidated consolidation.In the current fiscal year, corporate tax costs have decreased more than expected, which also greatly exceeded the outlook as of February.

The consolidated sales on the full year is 730.5 billion yen.Despite being influenced by the new colon virus in the first half, the recovery of the market environment was seen in the second half, especially in the fourth quarter, both the endoscopic business and the treatment equipment business.As a result, the number of sales has been reduced by 3 %.

The gross profit was 459.5 billion yen.In addition to the decline in operations due to the influence of the new colon virus, there were some factors that boosted the cost rate, such as listing the voluntary collection costs of endoscopy products and treatment equipment, but the decrease rate has been greatly improved in the latter half of the year.Doing.

The sales expenses were 357 billion yen.In addition to the restrictions on activities, while continuing strict management and efficiency, the necessary investment and measures are implemented, resulting in 48 sales pipe costs..It was 9 %, less than 50 percent.

Other costs are increasing.Although it is included in the full -year forecast, the cost associated with the external transfer support system was increased by about 12 billion yen in the fourth quarter.In the fourth quarter, the profit has increased even after absorbing this cost.

Operating profit is 82 billion yen, operating profit ratio is 11.It was 2 %.Although it is a little, it exceeds the outlook as of February.The income of the continuous business was 65.7 billion yen.In relation to the transfer of the video business, corporate tax costs decreased significantly, and the profit increased by 8 % year -on -year.When the continuous business and the non -continuous project were combined, the income was 13 billion yen.

Although the loss of about 50 billion yen associated with the conclusion of the transfer contract for the video business was greatly exceeded the outlook as of February.Regarding the dividends at the end of the term, based on the policy of increasing the number of stable and continuous dividends, the most recent performance will be 12 yen, which will increase from 10 yen to 2 yen announced in February.

Monthly sales changes (January 2020 -March 2021)

Please see page 6 of the slide.I would like to explain the status of monthly sales.This graph shows monthly sales changes by business with 100 % of the previous year sales.

At the beginning of the year, it was forced to be prepared for a very severe full -year performance, but it recovered with each moon, and both the second and fourth quarter grew.Especially in March, the endoscopic business is 23 % compared to the same period of the previous year, and the treatment equipment business has grown 28 %.

Final year of 2021 full -year results ② Endoscopic business

Next is the slide page 7.I will explain the outline of each segment.The first is the endoscopic business.The full -year sales were 419.5 billion yen.Following the recovery in the latter half of the market, it remained a little less on a real basis, excluding exchange rates.

By region, the number of sales in Europe and China, where Britain and Eastern Europe have been performing well, and by product, the sales of the tip -cap detachable duodenaloscopy and the endoscope of the bronchodo have increased.The fourth quarter is a significant increase in sales, following the third quarter.The recovery trend in the market environment has continued, and it has grown two digits in China, North America and Japan.

In China, the company was affected by the new colon virus in China last year, especially in the increase in sales, and in North America, the market environment was expanded in addition to the recovery of the market environment.In Japan, capital investment has increased, mainly in public and national hospitals that received supplementary budgets, and sales have increased.

By product, in addition to the "EVIS X1" system and scope, the duodenaloscopy and the endoscope of the jurisdiction also contribute to the increase in sales.

Operating income for the full year is 104.7 billion yen.Real -based operating profit margin except exchange rates is 25.It was 8 %.The cost of about 6 billion yen for the endoscope cost and the cost of about 4 billion yen associated with the external transfer support system was recorded, but the recovery was recovered, and the level was secured on the same level as the previous year except for foreign exchange.

In the fourth quarter, the costs associated with the external transfer support system were recorded, but in the same period of the previous year, the duodenal endoscopic cost was recorded by 10.4 billion yen, which significantly increased by 61 % on a real basis except for foreign exchange.I did it.

Final year of 2021 full -year results ③ Treatment equipment business

It is 8 pages of slide.It is a treatment equipment business.The sales were 206 billion yen.The treatment equipment business has also been recovered from the second half, and the decrease in the decrease is significantly reduced to a minus 4 % on a real basis except for exchange rates.In the fourth quarter, the market environment has been recovered, and the number of sales has been significantly increased.

In all areas, positive growth, especially China, affected by Coronavirus in the same period of the previous year, has been performing well.By product, the increase in sales of respiratory treatment equipment and urology products is leading.

Operating income for the full year is 24.6 billion yen.Real -based operating profit ratio excluding exchange rates is 12.It was 6 %.

In addition to the decrease in sales, the voluntary cost of the treatment equipment was set up by about 2 billion yen, etc., and the gross profit of the treatment decreased, but the depreciation of the pipe expenses and the depreciation of the Gyrus intangible assets that had been recorded until the previous year have been recorded this year.Due to the effects of disappearing, the actual operating profit margin on the actual basis except for the exchange rate is 0 year -on -year..It has improved 5 points.

In the fourth quarter, the cost of about 1.5 billion yen associated with the external transition support system was recorded, but the main factor was the recovery of sales, with a significant increase in profits on a real basis except for foreign exchange.

F full year's passage results for the fiscal year ending March 2021

Next, science business.See the 9th page of the slide.The sales were 95.9 billion yen.The recovery tendency for the latter half of the year has been reduced to a real base except for the exchange rate, minus 8 %.

While biological microscopes and industrial microscopes have been performing well in China, it has been reduced in capital investment motivation and sales activities in the aviation industry.On the other hand, sales are increased in the fourth quarter.With the recovery of the market conditions, budget execution and capital investment status have been improved, and biological and industrial microscopes and fluorescent X -ray analysis have been strong.

Operating income for the full year is 4.9 billion yen.Real -based operating profit margin except for foreign exchange is 6.It was 2 %.The main factor is the decrease in sales and the decrease in operating bases due to the decrease in operating bases.

In the fourth quarter, the cost of about 1 billion yen associated with the external transfer support system was recorded, but sales have recovered to the same level as the previous year, and the efficiency of sales pipe expenses has been improved, and 17 % on a real basis excluding foreign rates.The profit has increased.

Financial status statement

Please see the 10th page of the slide.It is the financial state at the end of March 2021.Current deposits have increased due to additional funding corresponding to the new colon virus.In addition, the acquisition of Veran Medical Technologies (Bellan Medical Technologies) has increased the number of goodwill and intangible assets.

Due to the increase in interest -bearing debt, the equity ratio is 3 compared to the end of the previous term..1 point reduced, 33.It was 4 %.

Connected cash flow statement

See the slide page 11.It is a cash flow situation.Against the backdrop of the improvement of profit levels associated with the recovery of business performance, the decrease in the decline from the previous year further reduced to ¥ 124.1 billion.

投資キャッシュフローは、M&Aの実施による約450億円の支出、映像事業譲渡に伴う約280億円の支出等がありましたが、仮にこれらを足し戻すと、フリーキャッシュフローは前年並みの水準でございます。

Financial cash flow increased by 60.3 billion yen due to long -term borrowing and procurement by issuing corporate bonds, to 40.8 billion yen.At the end of the term, cash and cash equivalents increased by 54.8 billion yen to 217.5 billion yen.

Full -year business outlook ① Consolidated performance

Next, I would like to explain the business outlook for the fiscal year ending March 2022.See the slide page 13.It is a full -year business outlook for the fiscal year ending March 2022.The assumed exchange rate, which is the premise of the performance outlook, is 108 yen per dollar and 130 yen per euro.

Sales are expected to grow in all businesses due to the recovery of the market environment and the growth of new products, and it will be 10 % growth.Salit expenses are expected to increase compared to the previous year.While devising, we are planning to increase the cost on the premise that activities become more active, but also invest in strengthening management platforms and improving profitability.

Operating income is about 50 % from the previous year to 126 billion yen.The operating margin is about 16 %, and the income is 89 billion yen, both of which are expected to be the highest ever.Regarding the dividends, we plan to increase the dividend to 14 yen, which will increase by 2 yen, based on the policy of increasing the dividends stably and continuously.

Full -year business outlook ② Segment -by -segment performance

The explanation from me is the last slide, see page 14.It is a business outlook by segment.The endoscopic business is expected to increase sales and profits, mainly on the EVIS X1, the Evis X1.

The treatment equipment business is expected to increase sales and profits due to sales of the acquired companies in addition to the recovery of the number of cases.The scientific business plans to promote the efficiency of sales pipe expenses in addition to the recovery of the market environment and the sales growth in China, and the operating margin will be about 10 %.

Regarding all companies and erasure, it is expected that the cost of the video business transfer that occurred in the previous term and the cost associated with the external transfer support system will be significantly improved.

After this, I would like to explain from the CEO Takeuchi to look back on the fiscal year ending March 31, 2021 and the management policy in the fiscal year ending March 2022.That's all for me.Thank you very much.

To the sustainable growth of the business and the realization of a sustainable society

Yasuo Takeuchi: Hello everyone, I'm Takeuchi of CEO.As Takeda explained, in the fiscal year ending March 2021, we faced an unprecedented situation of expanding the infection of the new colon virus, but in the latter half of the year, sales recovered significantly, and both sales and profits were in February.We have achieved the outlook that has been revised upward.

In addition, it has been a year when various measures were implemented with the aim of becoming a true global medical technology company.I would like to explain about the last term and the management policy of the current term.

First of all, I would like to explain the direction that Olympus aims for for a true global medotech company.See the slide page 17.

First of all, I will explain about ESG initiatives.Olympus is striving to realize the health and security of the world through responsible corporate activities, and has six important ESG areas in the management strategy announced in November 2019.We set four important tasks and materiality.

This time, we have identified the five materials of Olympus, including this environmental perspective, contributing to the realization of a car calectrion and recalculated society in cooperation with society.Through business, we will work on solving these social issues to achieve sustainable growth of Olympus and realize sustainable society.

As we announced in yesterday's news release, Olympus has expressed his support in TCFD's proposal and set a goal to realize carbon nuoral by 2030.We will continue to focus on highly transparent information disclosure focusing on strengthening CO2 reduction efforts and analysis of the risks and opportunities caused by climate change.

In order to achieve carbon native goals, we will continue to promote manufacturing improvement activities and energy saving measures, and by 2030, all costs -to -consumption power in our business establishments will be gradually switched to renewable energy, and CO2 reduction.We will accelerate the efforts of.

Strategic goals and performance indicators

Please see page 18 of the slide.Next, I would like to touch on the strategic goals and performance indicators that I have shown in the management strategy.Olympus is a strategic goal of growing into a world -leading medotech company, bringing benefits to all stakeholders with innovative value, and contributing to the health of the world.

Based on this concept, we have declared that it will grow sustainably, achieving a 5-6 % annual sales growth rate of 5 to 6 %, which is the same level as the global medotech.For this goal, we will continue to promote reform steadily.

Environmental recognition

Now, I would like to look back on the first year of the management strategy, which is the first year of the management strategy.Please see the 20th page of the slide.This slide is an environmental recognition slide shown in June of last year when the announcement of the full -year outlook was postponed due to the influence of the new colon virus infection.

While recognizing that the expansion of the new colon virus infection will bring a major change in values, the expansion of long -term medical needs is unchanged, and it is true for sustainable growth in the fiscal year ending March 2021.It is a good opportunity to accelerate the conversion to the global medotech company.

Execution of corporate reform

See the slide page 21.Based on the environmental awareness of the environment, we have announced that we will implement the five measures here in the fiscal year ending March 2021.

As described here, it was a year of acting all measures and accelerating the transformation to the true global Medotech Company for sustainable growth.Let's look back one by one.

First of all, we have transferred the video business for the selection of business portfolios and concentration, and have implemented an external relocation support system in Japan regarding structural reform of fixed costs.

Both are our long -term management issues, and although it was a very difficult decision for management, it is an inevitable measure to aim for a true global medotech company and change into a performance -oriented organization.I thought it was and did it.

In the first half of 2020, we launched a long -awaited endoscopy EVIS X1, a long -awaited endoscope in Europe, some regions in Asia, and in Japan.Doctors in each country have received a very high reputation, and we are convinced that we will lead the future business of Olympus.

今後の成長を牽引する製品開発への着実な投資継続につきましては、医療分野の成長に向けて複数のM&Aを実施いたしました。買収した企業の製品ポートフォリオや技術のシナジーを高めることにより、持続的な成長に貢献することを期待しております。

Finally, efficient R & D has been promoting efforts to strengthen concurrent engineering at the front phase.From this April, we will reorganize a conventional product development organization from a technology -specific organization to achieve efficient and quick product development.

Sales*: Recovery of business performance based on solid medical demand

See the slide page 22.I would like to look back on business performance.At the beginning of the period, it was difficult to see its performance due to the unprecedented situation of global pandemic, and it was assumed that it would be a very severe year, with sales and profits greatly declined.

However, as a result, it was converted to positive growth compared to the same period of the previous year in the third quarter, and in the fourth quarter, 12 % growth was achieved compared to the same period of the previous year.The fourth quarter track record is higher than the pandemic, which is higher than the results of the fiscal year ending March 2019, and is the result supported by the solid demand for early diagnosis and minimal invasive treatment.

Next, I will explain the management policy for the fiscal year ending March 2022.Slide 24 pages.As a management, we will work on the continuation and establishment of corporate reforms that have been carried out last year, with the deepening of the global medotech company as the theme of this term.

FY2022 Point Measures

Next, I will explain the management policy for the fiscal year ending March 2022.As a management, we will work on the continuation and establishment of corporate reforms that have been carried out last year, with the deepening of the global medotech company as the theme of this term.

Please see the 25 page of the slide.Here are 4 important measures for this term.Last fiscal year, we have carried out various corporate changes, but we will strive for the change this term without relaxing.

The current Olympus is considered to be in a phase to deepen from the shift to the global Medotech Company that we have been working on.Olympus has developed a practical gastric camera for the first time about 70 years ago, and has developed products and procedures on a tripod with a doctor, and has grown in support of a high -gas gastrointestoscopy market.

In order to create products and solutions based on trust with doctors, and to provide high value -added value, we will continue to achieve a continuous high -profit growth in the future.We believe that it is necessary to deepen the medical business strategy according to the concept shown.

I would like to steadily proceed with the efforts of the four key measures here, and report to everyone through IR events such as the announcement of the financial results this term.

In addition, we are currently considering medical business strategies.We plan to explain in "Investor Day" introduced in the slide after this.

UPCOMING INVESTOR EVENTS

See the slide 26 page.We will inform you about future IR events.This year, we plan to hold "Investor Day 2021" for the first time in three years.The details of the date and time and contents will be announced again as soon as it is decided.Please participate by all means.

Lastly, in the fiscal year ending March 2021, in the unprecedented strict situation of the new colon virus infection, we decided to make sure that corporate reform was always implemented, so we decided on various measures and implemented various measures. did.

This year, in the fiscal year ending March 2022, we are positioned as an important year to link many measures taken in the previous term to results and establish performance -oriented culture.We will lead the company and work together to further promote corporate transformation.

We would like to thank you for your continued support from stakeholders.That's it for me.thank you for listening.